https://boardagenda.com/2022/04/22/battle-of-the-boards-risk-esg-and-two-tier-board-structures/

Published in Board Agenda 22 April 2022

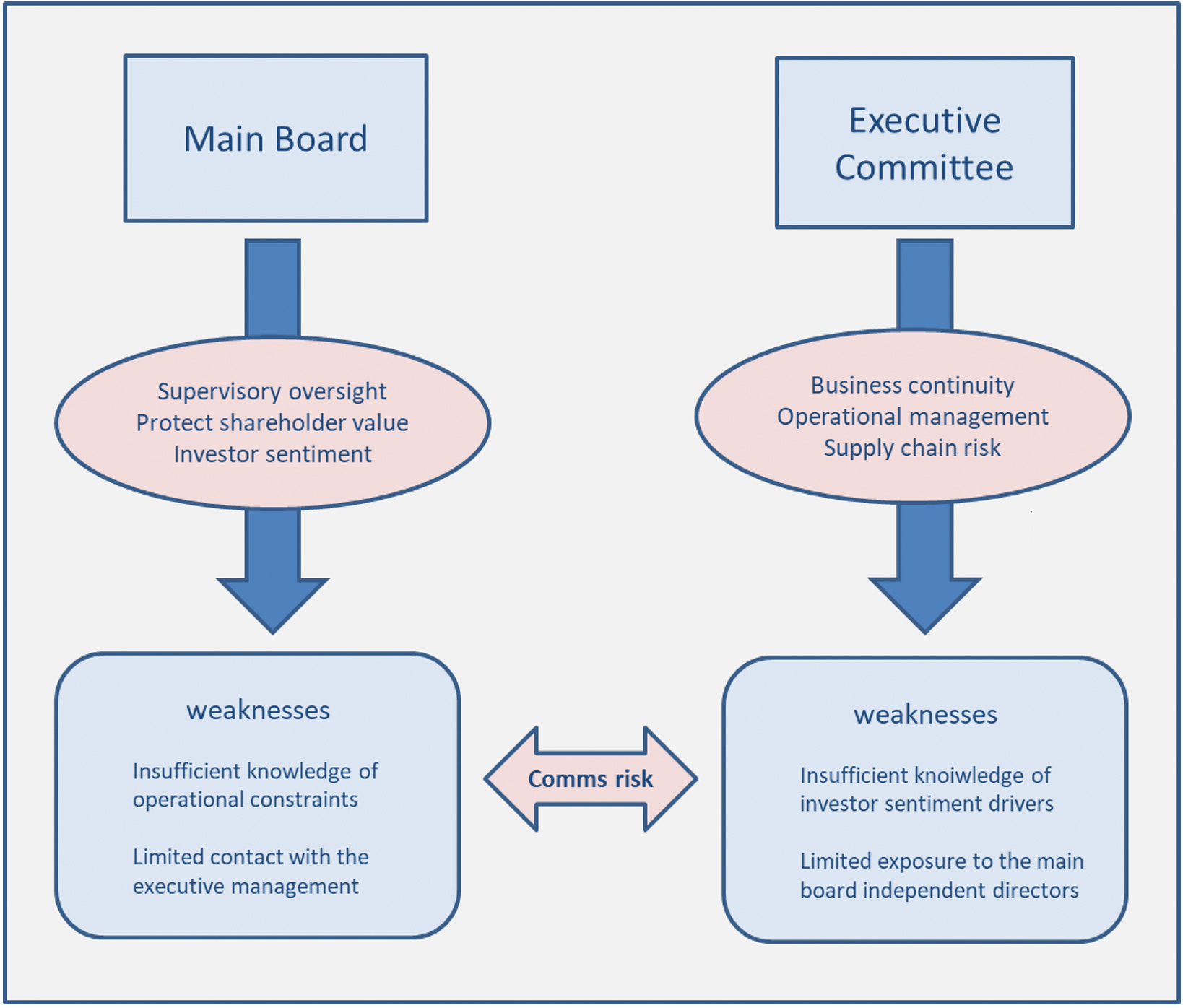

So, your risk committee reports to the board and can distinguish between operational and strategic risk, but to which board does it report? In many international corporations the main board is not the executive board, when incorporated under European law there is often a two-tier board structure. The CEO and executive board run the company on a quarterly performance basis as operational management, but the Chair and main board will supervise shareholder value as they represent shareholder interests, keenly aware of ESG sentiment in attracting and retaining investors.

There is an inherent conflict of interest here between the two boards, not only with two different time horizons but two different risk impacts. There are no easy answers and invariably compromise is needed from both sides to secure a mutual benefit. The main board need to better understand the way the business works as an engine of inputs and outputs, whereas the executive board needs to better understand the expectations of investors regarding ESG and the geo-politics that drives it.

Any stakeholder map used by the executive board will balance the interests of primary stakeholders: either as revenue inputs – customers and investors or cost outputs – employees and suppliers. It will also pay close attention to secondary stakeholder groups who have power and influence such as regulators and media. Now consider the main board focus of attention: it rests only on investors, present and future, dividend return and sentiment. The main board see risk only in terms of share price stability and investor confidence, nothing else. The CEO and Chair need to bring these two different perspectives into focus to help make informed decisions benefitting the business.

The board of P&O Ferries took a commercial decision to reduce operating costs, no doubt under pressure from its parent company to deliver an operating profit. The parent company, Dubai based privately owned DP World, had been working with the UK government to win new port operator contracts, but these were jeopardised as a local reputational risk escalated into an international political one. Although P&O Ferries had a representative of DP World on their UK board, their risk assessment for a commercial decision failed to consider collateral damage to the parent company.

Sanctions on Russian goods offer another example of conflict. Supply chains for all kinds of item have been put under strain through taking a major source of raw material out of the equation. If your business needs oil, gas, coal, nickel of fertiliser from Russia then you will be tempted to find a way to secure it, if necessary through any third party willing to supply. However, your main board will veto any such move as it risks investor flight and long-term reputational damage. Any risk assessment undertaken by the CRO of a two-tier corporation needs to consider not only the type of risk being considered but on which stakeholders it impacts most: customers or shareholders?

Differences in risk perception between executive and main board can lead to frustration on both sides. The executive will berate the main board for insufficient understanding of the nature of the business, especially the constraints of delivering quarterly performance targets designed to deliver investor assurance, where no clouds must be allowed to show on the horizon! Conversely the main board will become with frustrated with an executive board that cannot appreciate the significance of ESG metrics regarding Sustainability in the face of climate change. There is an education task on both sides if the two-tier structure is to work optimally.

What is the solution? Improved communication between the two tiers to understand the perspective of the other. It is what Michele Wucker would call ‘risk empathy’, the ability to see the other person’s point of view. It’s a factor to consider when reaching collective decisions in a boardroom. It helps you better understand where someone is coming from, rather than making assumptions. It is not about the risk itself but on whom it impacts and how they perceive it.

The Chair has a duty to ensure that non-executive or independent executives on the main board understand the nature of the business, he/she must ensure rotation of the board to bring in fresh and wise counsel to adequately represent shareholder interests. The CEO has a duty to ensure that his executive board members understand the investment landscape in which their business operates, the wider ecosystem of resource utilisation and global impact, because this is what drives investor sentiment and influences the main board in its decision making.

© Garry Honey – Chiron Risk – April 2022