A survey published in the Sunday Times recently suggested that reputation could be the biggest future risk for any business. Quoting a variety of sources the Raconteur report claimed that increasing awareness of social and corporate injustice among the wider public provides new opportunities for reputation damage. This consequently means boardroom agendas need to take notice. Is this really true?

Certainly bad news travel faster in the internet age with social media platforms ideal for mischievous or malicious opinion forming, but this itself is hardly news and key stakeholder audiences normally verify stories from a variety of trusted sources before taking a view. News no longer comes only from moderated and professional channels but the public is becoming savvy about not only story source but also motivation to publish – fake news invariably has a political or commercial agenda.

The survey jointly published by the Sunday Times and Airmic (a trade association for the insurance industry) quotes from a Deloitte survey among global chief executives in 2018. While 53% of respondents confessed to having no process for identifying reputation risk, a further 40% took the view that reputation should be treated as a consequential risk, a by-product of other hazards such as security threats. This view is increasingly shared by organisations who understand that reputation damage follows from another failure which should be mitigated within a risk reporting framework.

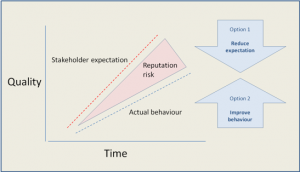

Reputation risk is still as important as it was before the internet age provided the channel for faster news dissemination. It is still a behavioural not communication risk and exists where performance or behaviour falls too far short of expectation of key stakeholders like shareholders or customers. Managing the risk is still a question of closing this gap between expectation and behaviour. Once a risk to reputation has been acknowledged there are only two strategic options: reduce expectation or improve performance. Neither is straightforward but each provides protection from damage.

Reputation risk is still as important as it was before the internet age provided the channel for faster news dissemination. It is still a behavioural not communication risk and exists where performance or behaviour falls too far short of expectation of key stakeholders like shareholders or customers. Managing the risk is still a question of closing this gap between expectation and behaviour. Once a risk to reputation has been acknowledged there are only two strategic options: reduce expectation or improve performance. Neither is straightforward but each provides protection from damage.

Reducing expectation takes time and for shareholders there are only so many way you can deliver bad news. Customer expectations can be managed downwards and there are plenty of examples where expectation of quality service has been reduced effectively to reduce disappointment. Improving behaviour or performance also takes time but can only be done effectively against criteria the audience values not the business itself. Both options for change require a deeper understanding of what audiences expect and must start with attitude research, a tool social media can provide.

For more information contact info@chiron-risk.com