As we approach the first anniversary of the pandemic outbreak, it is clear that the future of work is going to change forever, and normal is not something to which reversion is possible. Managing an uncertain future now tops the agenda for governments and corporations around the world. Selecting the right leadership strategy requires not simply foresight, but an understanding of how to tackle different types of uncertainty.

A century ago the Chicago economist Frank Wright make the distinction between risk and uncertainty that has largely been ignored until more recently revived through the work of Mervyn King and John Kay in their book ‘Radical Uncertainty’. Wright held that risk was something that could be calculated but uncertainty defied calculation. Why has this distinction lain so underused for the past hundred years?

The answer lies in the human desire to calculate probability of an outcome in order to reduce uncertainty. This is a reasonable expectation but it produces quantification for the sake of it and doesn’t actually add information to reduce uncertainty. Probability aids confidence in decision making but this is frequently misplaced. The economist Robert Skidelsky is sceptical about probability: ‘A central danger stemming from the use of probability is that it provides …the self-delusion that the uncertainty of the future is fully measurable and has been tamed.’

Not only do King and Kay rehabilitate the distinction between risk and uncertainty first postulated by Wright in his 1921 book: ‘Risk, Uncertainty and Profit’, but they also credit Greg Treverton a senior figure in the US intelligence community for his astute description of the difference between puzzles and mysteries. ‘Puzzles can be solved, they have answers, mysteries are imbued with vagueness and indeterminacy…..either because the outcome is unknowable or because the issue is ill defined’.

As the pandemic impacts economies and businesses, the challenge for leaders is to separate different types of uncertainty into puzzles and mysteries. It will be tempting to apply probability analysis to mysteries, but this will not reduce uncertainty it will only lead to false confidence. Mysteries cannot be solved through calculation of a probable outcome; they must remain mysteries, far better to focus on the puzzles which can be solved as there are at least two distinct types of puzzle and acknowledging the distinction is helpful to foresight.

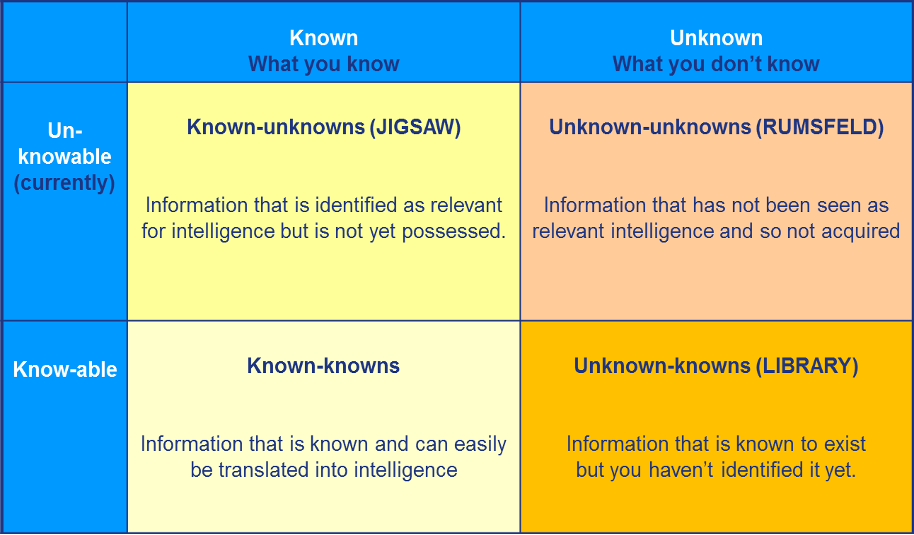

Puzzle uncertainty is a type that can be solved or reduced through added information, the challenge is to recognise whether this already exists or needs to be created. I have always used the terms ‘Library’ and ‘Jigsaw’ as in the diagram attached. Library uncertainties can be solved through finding existing information or interpreting gathered data in a new way. Jigsaw uncertainties require information to be created through new research or data gathering to reduce uncertainty. These are usually pieces of information that add value much as missing pieces to a jigsaw puzzle.

Managing uncertainty is not something that requires experts in risk or economic forecasting, but it does require an appreciation of those uncertainties that can be solved and those that cannot be irrespective of a desire to seek out probabilities to make decisions easier. You will note that those things we don’t know and cannot even appreciate we don’t know arte called Rumsfeld uncertainties in this model. They are named after Donald Rumsfeld and clumsily referred to as ‘unknown unknowns’.

To summarise, the leadership challenge for handling uncertainty is to distinguish between jigsaw and library types, this will help determine the right approach. Uncertainty is always reduced with knowledge, but it cannot be reduced through probability.

Garry Honey, Founder of Chiron Risk www.chiron-risk.com